单选题

2024-06-29 01:36:31

错误率:

3%

105 人做过

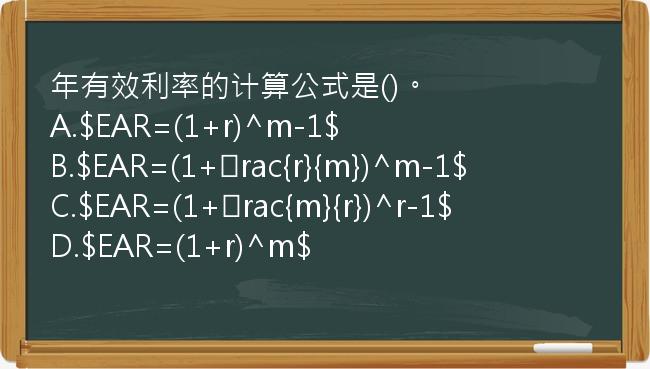

1.年有效利率的计算公式是()。

A.$EAR=(1+r)^m-1$

B.$EAR=(1+ rac{r}{m})^m-1$

C.$EAR=(1+ rac{m}{r})^r-1$

D.$EAR=(1+r)^m$

【答案】

B

【解析】

年有效利率(EAR)的计算公式为:$EAR=(1+ rac{r}{m})^m-1$,其中r为名义利率,m为一年中的计息周期数。

【记忆技巧】

公式中有两个m,一个在分母,一个在指数上,表示周期和次数的关系。

搜索

搜索